Maria Rodriguez, CFO of a $2 billion manufacturing company, walked into the Monday morning executive meeting with news that shocked everyone.

"We need to cut our aluminum orders by 40% immediately," she announced.

The room erupted. The head of operations protested—they had production schedules to meet. The CEO questioned her sanity. The procurement director showed charts proving aluminum prices were stable.

Maria smiled and pulled up her AI dashboard. "In 72 hours, aluminum prices will spike 23%. Our competitor just filed for a massive order that will drain regional supply. My AI caught the pattern in shipping data, supplier communications, and futures market micro-movements that human analysis missed."

Three days later, aluminum prices skyrocketed exactly as predicted. Maria's AI-driven insight saved her company $47 million. Their competitors? Locked into high prices for the next quarter.

This isn't science fiction. It's the new reality of AI-powered financial leadership.

While you're still reconciling last month's numbers, AI-equipped CFOs are predicting market shifts months in advance. They're finding patterns invisible to human eyes. They're turning finance from a rearview mirror function into a strategic crystal ball.

Welcome to the AI revolution in finance—where the CFOs who adapt will thrive, and those who don't will be explaining to their boards why they missed the obvious.

Here's what should terrify you: 58% of CFOs are actively using AI in their finance functions, according to Gartner's 2024 CFO Survey. But feeling prepared and actually implementing are two different things.

The reality? While you're "preparing," your competitors are already:

The gap between AI leaders and laggards isn't growing—it's exploding.

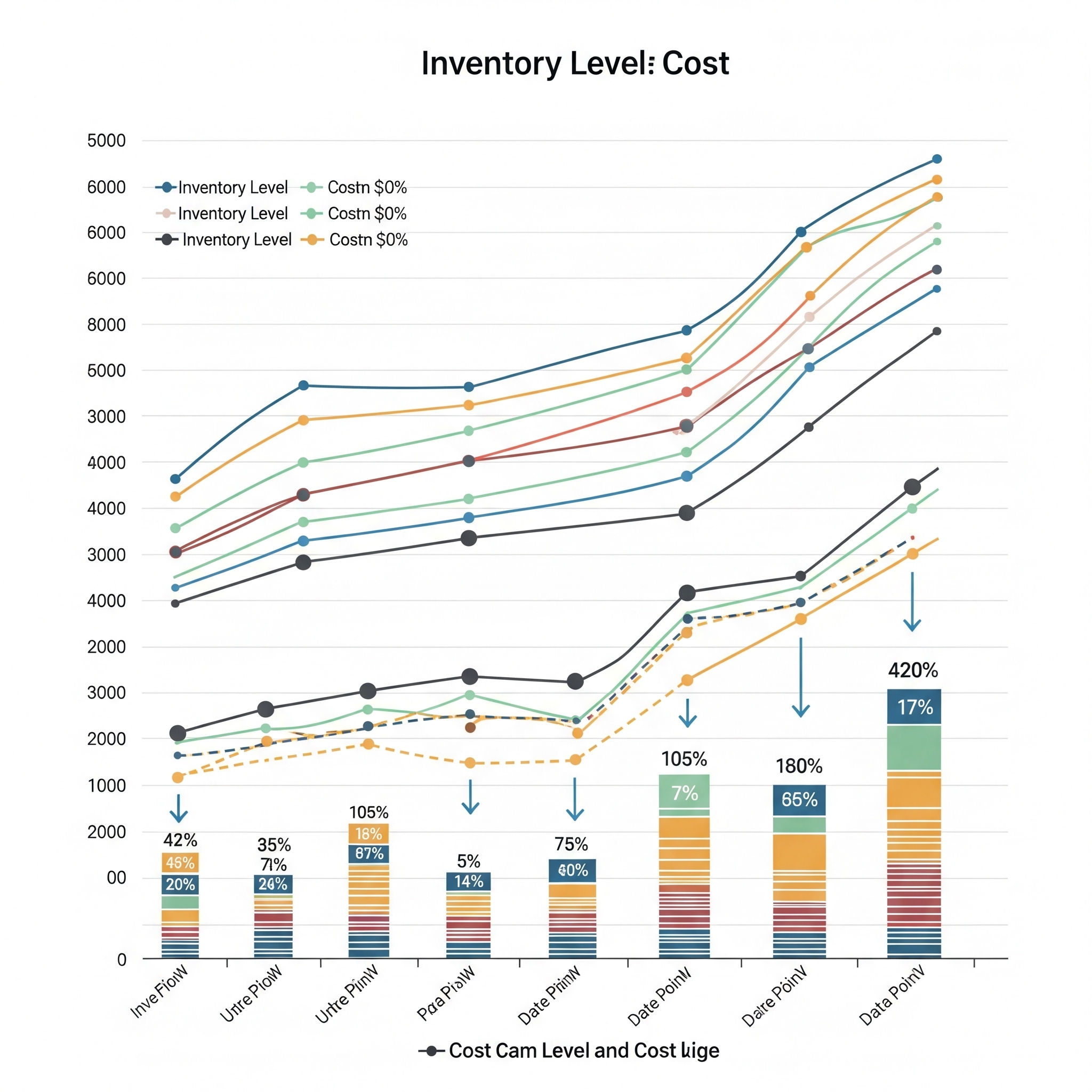

Your team is drowning in data. Every day, your systems generate millions of data points. Your analysts spend 80% of their time gathering and cleaning data, leaving only 20% for actual analysis.

Meanwhile, AI-powered finance teams flip that ratio. They spend 80% of their time on strategic insights because AI handles the grunt work.

As noted at the World Economic Forum 2024: "AI is the most important advance in technology since the personal computer." For CFOs, it's even more critical—it's the difference between leading and bleeding.

Most AI implementations fail because CFOs start with technology instead of objectives. Don't be most CFOs.

The SMART AI Framework for Finance:

Real example: A mid-market retailer using Vic.ai started with just accounts payable automation. Result? 87% reduction in invoice processing time, freeing their team for strategic work.

The AI tool market is flooded with promises. Here's how to cut through the noise:

Three Categories of Financial AI Tools:

1. Finance-Specific Platforms

2. Enterprise AI with Finance Modules

3. Custom Solutions

💡 Integration Reality Check: 37% of AI projects fail due to integration issues. Always verify pre-built connectors for your ERP before committing.

Here's an uncomfortable truth: Your data is probably garbage. And AI amplifies garbage into catastrophic decisions.

Gartner research shows poor data quality costs organizations an average of $12.9 million annually. For AI-driven finance, multiply that by 10.

The 5-Point Data Quality Checklist:

One Fortune 500 CFO discovered their AI was making bad predictions because their European subsidiary was entering dates as DD/MM while headquarters used MM/DD. This simple error cost them $3.2 million in misallocated inventory.

Financial prediction isn't about complex algorithms—it's about business impact. The best CFOs focus on models that drive decisions:

As one data scientist noted: "We know the what, but we don't know the why. For many projects, the objective is more to predict than to understand." This is perfect for finance—you need to know WHAT will happen to cash flow, not necessarily WHY customers pay when they do.

BCG research shows AI-enabled CFOs spend 70% more time on strategy versus operations. They're not replacing humans—they're elevating them.

Take Ziad Chalhoub, CFO at Majid Al Futtaim: "Over the past two years, AI has become a priority for CFOs. My insights: AI integration is essential in corporate strategy, CFOs should ensure positive return of investments from AI, and interdisciplinary teams should cultivate AI expertise."

The Strategic CFO's AI Playbook:

Cross-functional collaboration isn't optional—it's essential. Companies with cross-functional AI teams achieve 32% higher ROI.

Your AI Dream Team:

Create a weekly "AI Insights" meeting where each department shares patterns they've discovered. You'll be amazed how sales pipeline data improves cash flow predictions.

Your financial data contains patterns that could save or make millions. But human brains can't process the volume or complexity. That's where ML shines.

St. Louis Federal Reserve reports: "Machine learning models now process alternative data sources—social media sentiment, satellite imagery, mobile location data—to provide nuanced understanding of market movements."

Real ML Wins for CFOs:

Finding patterns is worthless without action. The best CFOs create "Insight to Action" workflows:

Sarah Jarvis at MIT notes: "Data science is all about asking interesting questions based on the data you have—or often the data you don't have." The key is turning those questions into profitable answers.

Siloed data kills AI potential. Deloitte found integrated data approaches deliver 28% better prediction accuracy.

Breaking Down Silos:

One retail CFO combined point-of-sale data with weather patterns and social media sentiment. Result? Inventory optimization that freed up $23M in working capital.

Marc Benioff of Salesforce warns: "Artificial intelligence may be the most important technology of any lifetime." But importance doesn't guarantee success.

The Expensive Pitfalls:

The Solution: Human-in-the-loop systems where AI recommends but humans decide on anything over predetermined thresholds.

By 2027, global AI software spending will reach $297 billion. The machine learning market alone will hit $503.40 billion by 2030.

These aren't just numbers. They represent your competitors investing in capabilities that will let them:

Remember Maria Rodriguez from our opening? She's not unique anymore. She's becoming the standard. CFOs like her are using AI to transform finance from a support function to a strategic weapon.

You have three choices:

The companies that win in 2025 and beyond won't necessarily be the biggest or richest. They'll be the ones whose CFOs saw AI not as a threat to their expertise, but as an amplifier of their strategic value.

Sundar Pichai said it best: "The future of AI is not about replacing humans, it's about augmenting human capabilities."

For CFOs, that augmentation is the difference between managing numbers and shaping the future.

What's it going to be?